As Solana revisits the $160 level amid rising supply pressure, the bearish sentiment surrounding SOL’s price trend warns of a potential massive crash. Will the downfall push SOL to $106?

Solana is gaining bearish momentum by hitting its 3-month low price at $160. With four consecutive bearish candles in the daily chart, the trendline breakdown rally puts significant pressure on the $160 supply zone.

With a low price rejection and an intraday recovery of nearly 1%, bulls are clinging for a potential bounce back. Will short-term crypto market stability provide Solana an opportunity to reclaim the $200 psychological mark? Let’s find out.

SOL Price Trend Hits 3-Month Low at $160

In the daily chart, the SOL price trend reveals a massive surge in bearish momentum after the bullish failure on January 19, creating an all-time high of $295. Solana failed to sustain the bullish momentum, leading to a quick turnaround from the $260 supply zone.

The high-momentum Solana move broke below the long-coming support trendline, significantly increasing the bearish pressure over the $170 demand zone. As the short-term conditions reflect a high possibility of a breakdown rally, the lower price rejection on daily candles hints at a potential bounce back.

Currently, Solana is trading at a market value of $170, with an intraday recovery of nearly 1%. Despite the low price rejection, the technical indicators suggest a bearish continuation.

The contraction of the upper and lower Bollinger Bands indicates decisive bearish momentum. With the current Doji candle, bulls are hoping for a potential morning star pattern to form.

Solana Faces Negative Comments Amid Slow Growth

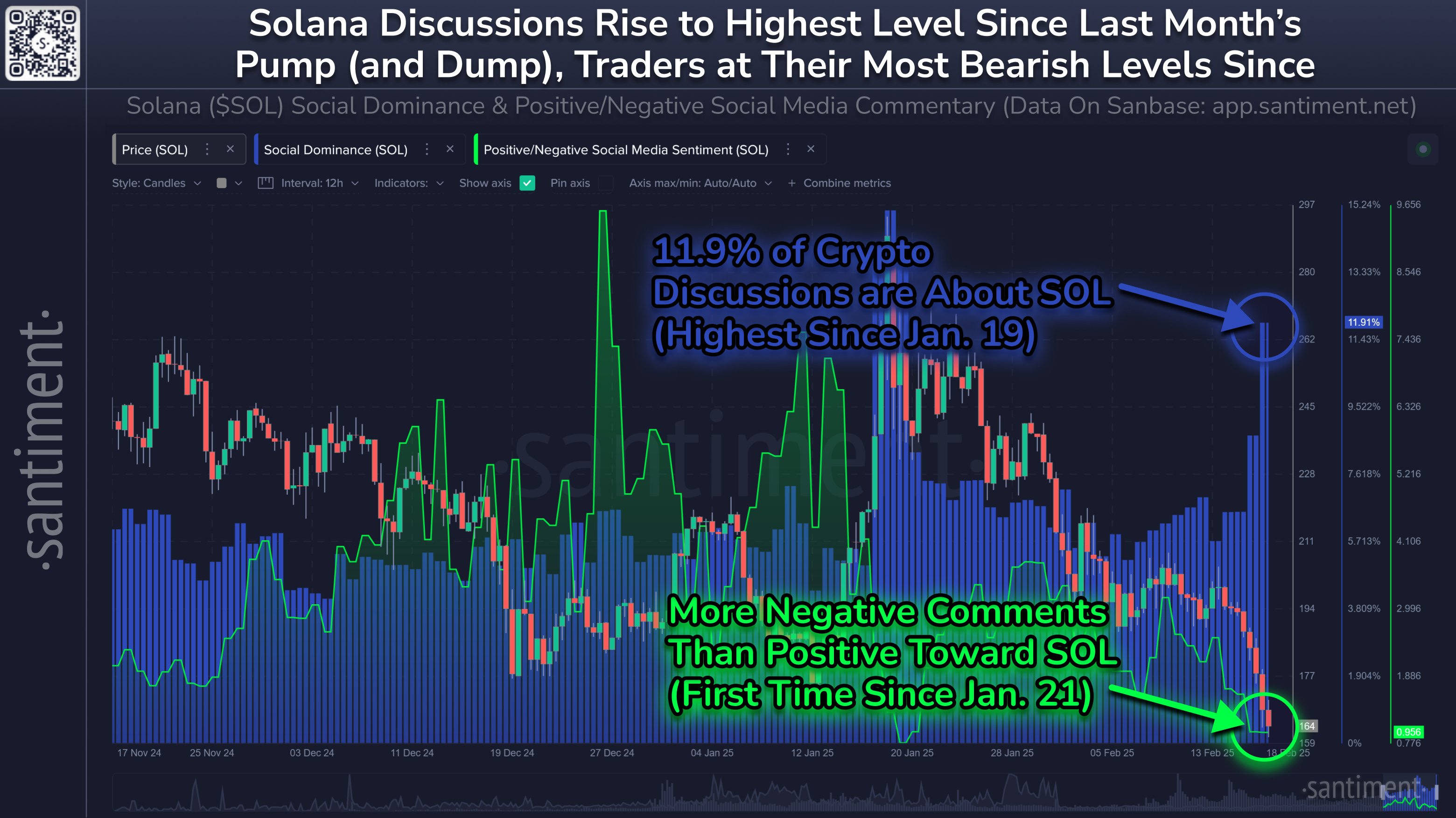

Solana’s declining social sentiment warns of a massive retracement. According to a recent tweet from Santiment, traders are expressing frustration over the ongoing downfall.

Furthermore, 11.9% of crypto discussions are about Solana, the highest since January. With increasing discussions and rising negative sentiment, Solana’s downfall seems imminent.

Whale Actions Suggest Long-Term Confidence

Despite the chances of downfall, a whale remains optimistic and buys the dip in Solana. A newly created wallet acquired 87,328 SOL tokens worth nearly $15 million.

After acquiring the tokens from Binance, the whale remained inactive, reflecting strong confidence in Solana’s long-term potential. While whale accumulation often signals a potential recovery, the ongoing bearish momentum remains a major concern.

Key Supports To Watch as Solana Crashes

Currently, Solana clings to the S1 pivot support level at $168. Based on price action analysis and pivot points, a closing price under $168 will likely result in a massive plunge to $106.

However, any bullish comeback would likely face resistance near the $200 psychological mark.

On a more optimistic note, the center pivot level at $231 could be the next price target if the uptrend regains momentum.

Source link